Deadlines:

P11D submission - 6th July

Class 1A NI - 22nd July (or Friday before if it lands on a weekend) or 19th July if paying by cheque

What is a P11D?

A P11D form is a HMRC document used by employers to annually report certain expenses and benefits in kind, paid or made available to directors and employees.

It is designed to provide HMRC with details of specific taxable benefits in kind which haven’t been included in the payroll and subject to PAYE and NIC deduction during the course of the year.

Every year, once the tax year has ended, a submission needs to be made to HMRC to advise them of the benefits provided to directors and employees, that the director or employee are due to pay tax on, and the business is due to pay Class 1A NI on.

What do you need to do?

Gather all the info on the various benefits provided to directors and employees which need to be reported on. Common items that need to be submitted on a P11D are Private Medical or Dental Insurance provided by the business, Company Cars, Private use of business equipment such as telephones.

Calculate the benefit and Class 1A NI due by the employer.

Class 1A NI is currently set at 13.8% (same rate is employers NI through PAYE). However, due to the Health & Social Care Levey that was introduced and removed in Tax Year 2022-2023, the rate to use for Tax Year 2022-2023 is 14.53%

Make an online submission of the P11D and P11D(b) forms to HMRC by the deadline of 6th July.

All P11Ds need to be submitted online from April 2023. This includes the submission for Tax Year 2022-2023. Amended P11Ds, which previously only could be submitted in paper form, now also must be submitted online. Submissions can be made through private software, or through a HMRC Government Gateway account (if submitting for less than 500 employees).

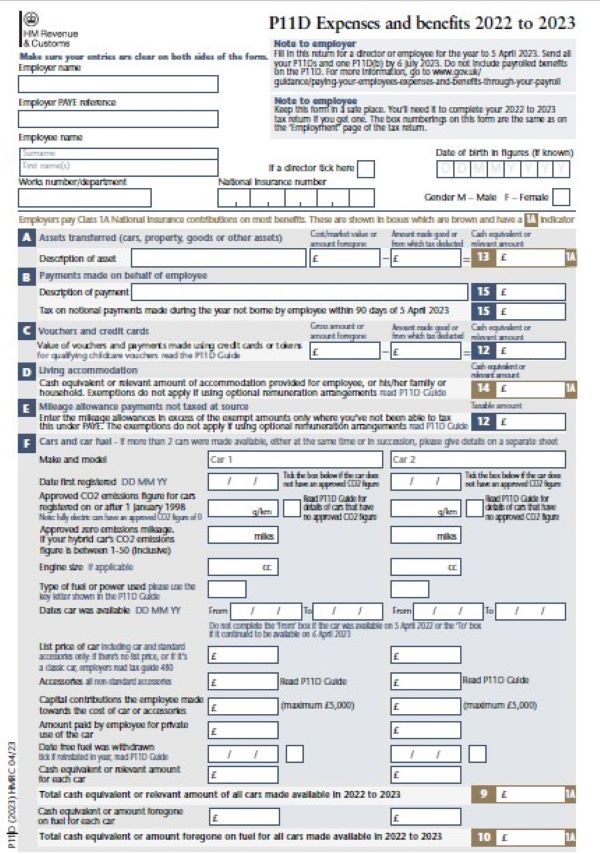

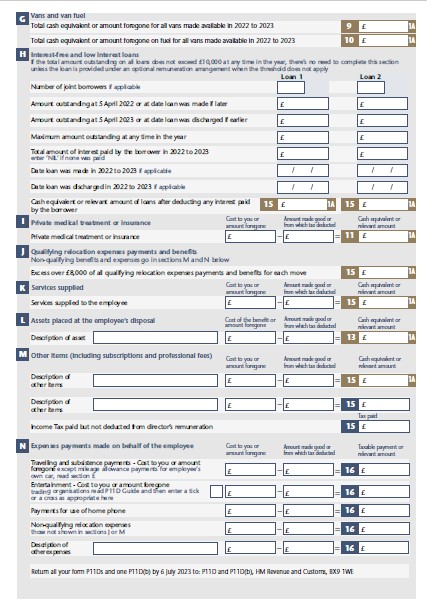

Provide each employee that you’ve submitted a P11D for a form to show how much has been submitted for them. See form example below…

What comes next?

HMRC will use the information submitted on the P11D for the director or employee to re-calculate how much tax their due to pay, and will send out a Tax Code notice to the employer to change the director or employees tax code. This means the additional tax due by the director or employee is collected from them, through the payroll, during what remains of the new Tax Year.

The employer then must pay the Class 1A NI due for the directors or employees benefit to HMRC by the 22nd of July (or the Friday before if the 22nd lands on a weekend), or by 19th July if paying by cheque.

See the link below to HMRCs P11D guidance...

https://www.gov.uk/guidance/how-to-complete-forms-p11d-and-p11db

Top 3 Tips for P11D submissions:

1 Keep good records throughout the Tax Year of your directors and employees’ benefits. This will make it much easier when it comes to submitting the P11Ds

2 Plan ahead for your P11Ds. Make sure you have enough time to get all the information you require and to make the calculations and submission to HMRC. Quite often it can be a bit of an exercise getting the information in about the benefits that need to be submitted, from directors and employees, especially if Tip 1 hasn’t been followed, so, request the information early after the Tax Year End has been completed.

3 Keep good records of what’s been submitted (I know similar to Tip 1). This is always a must in payroll though. Keep good records of what the benefits are and how the amounts submitted were calculated, in case of queries from directors, employees or HMRC. By keeping this information, knowing what’s been done before, you can make next year’s P11D submissions easier.

I hope this quick look at P11Ds helps. If you need more details and help, get in touch.

info@chanonrypayroll.co.uk

07734322909

All the best

Hayley

Director, Chanonry Payroll Solutions Ltd