Below are some info on rates and thresholds/changes for the new Tax Year...

Employment Allowance

The Employment Allowance (EA) will remain at, up to £5000.00, for Tax Year 2023-2024 for eligible employers.

To check you eligiblity take a look at HMRC's guidance Here

Tax

From 6th April 2023 the emergency Tax Codes are:

1257L W1

1257L M1

1257LX

This is the same as the previous tax year.

With an ‘S’ prefix for Scottish resident employees and a ‘C’ prefix for Welsh resident employees.

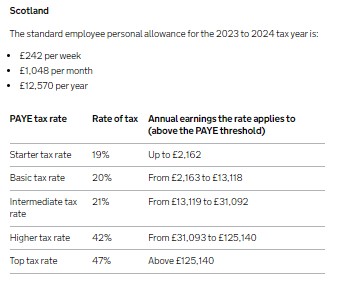

Scotland

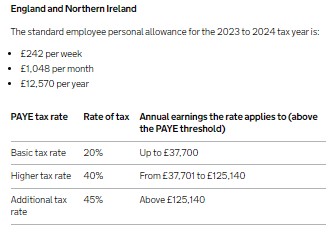

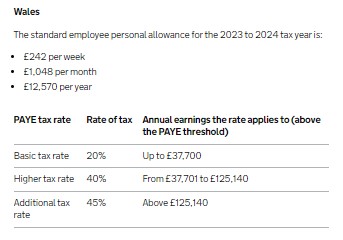

Rest of UK

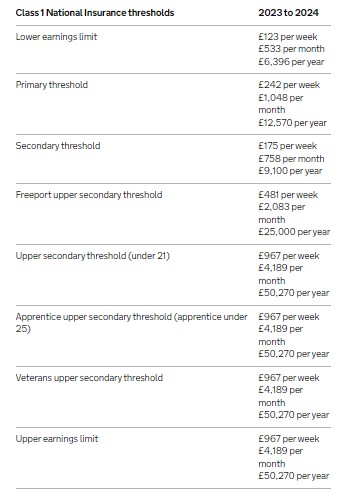

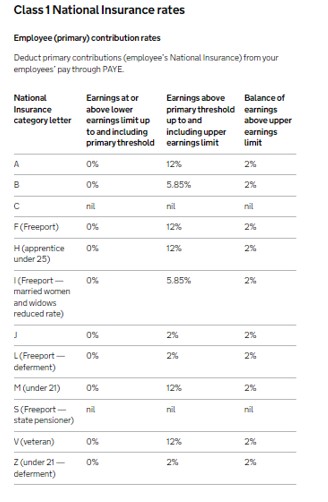

NI

Directors

For Tax Year 2023-2024 the Secondary Threshold (ST) and the Primary Thresholds (PT) are remaining the same as Tax Year 2022-2023.

For Tax Year 2023-2024 it will be…

ST £758.33 per month – This will keep the Director under employees and employers NI and Tax thresholds (dependent on individuals tax code)

PT £1047.50 per month – This will keep the Director under the employees NI and Tax thresholds (dependent on individuals tax code), but there will be employers NI due (this could be offset against the Employment Allowance if the business is eligible and the allowance is not used up)

Please consult your Accountant for the best salary for your Director, which takes into consideration Dividends and other income.

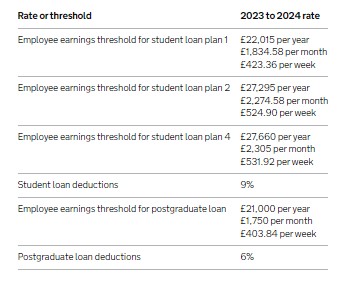

Student Loan Deductions

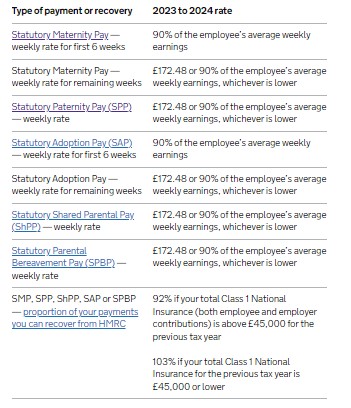

Statutory Payments

The new Statutory Payment rates are effective from 2nd April 2023…

SMP/SPP/SAP/ShPP/SPBP

SSP

Pension

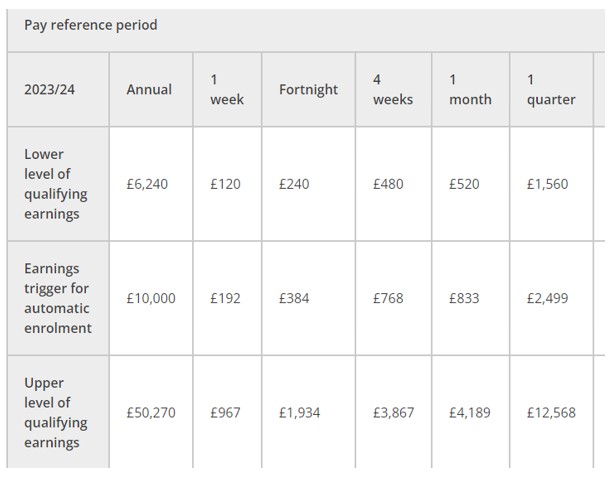

The Earnings Thresholds are remaining the same for Tax Year 2023-2024

Qualifying Earnings from Lower Earnings Limit of £520.00 per month to Upper Earnings Limit of £4189.00 per month, with the Earnings Trigger (the point where the employee goes above the earnings threshold for auto enrolment) of £833.00 per month.

The age thresholds, of 22 years old and under State Pension Age (currently 66 years old) will remain.

It was announced in the Spring budget, on 15th March 2023, that the annual Tax-Free Allowance for pension will be increased from £40,000 to £60,000, and the pension lifetime allowance will be abolished.

The government is currently in discussions to increase the State Pension Age to 67 years old for those who were born after 5th April 1960. Also, there are discussions to reduce the auto enrolment age threshold from 22 years old to 18 years old. Any changes to the current situation, is yet to be announced, but we anticipate an announcement within the next year or so, of some sort of change to the current pension auto enrolment set up.

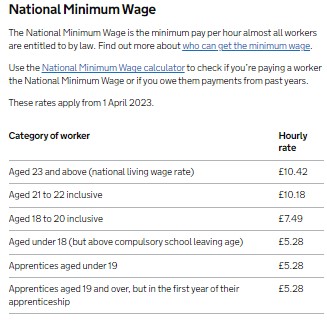

NMW/NLW

NMW rates need to be in place from the first pay period that begins on or after 1st April 2023. Therefore, if your April 2023 pay run pay period is for the calendar month, i.e., 1st April to 30th April, then the rates will need to take effect from your April pay run. If, however, you have a split month pay period, for example you pay from the 16th of March to 15th April in your April pay run, the rate will not take effect until your May 2023 pay run, as the pay run begins before the 1st of April.

There are plans to decrease the National Living Wage age from Tax Year 2024-2025 from 23 years old to 21 years old. If/when this will be happening, is yet to be announced.

Below is a link to a handy document that shows you Tax Weeks and Tax Months...

Tax Weeks - Tax Months_2023-2024

We hope you found the above helpful. We know it's a confusing and often frustrating time of year for Employers. If you have any questions on the new tax year, get in touch.

Hayley

info@chanonrypayroll.co.uk

07734322909